Edition No. 8

Yuga v. Ryder Ripps; 3AC backed in a corner; The durability of Bitcoin; DAOs at large; Crypto-Politics; and much more. Here's what happened from 6/20/2022-6/27/2022

Welcome to Around the Blockchain, a weekly letter dedicated to keeping readers up to date on the fast-paced world of Crypto & Law by airdropping current stories and projects directly to your browser.

Table of Contents:

1. On the Docket (Top 5 Stories of the Week)

2. Podcasts, Videos, & Blogs (The faces, voices, and pens of Web3’s brightest contributors)

3. Bird Watching (Tweet, tweet!)

4. Motion to Compel (Meant to provoke thought and action)

5. The Public Ledger (Highlights from our weekly library of sources, built by our Feedly AI)

6. Closing Statements

On the Docket

Five things you might have missed last week:

1. Yuga Labs Files Lawsuit Claiming Bored Ape Yacht Club NFT 'Copycats'

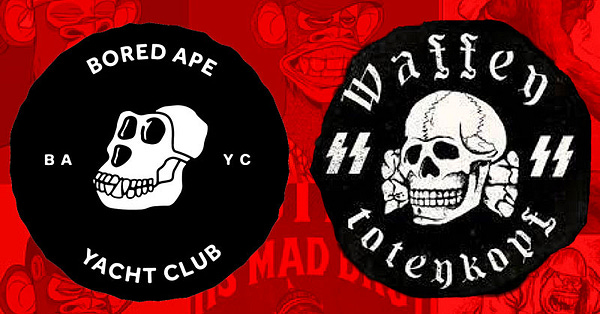

(JPEG) Monkey Business:

Yuga Labs, the creators of Bored Ape Yacht Club, have filed suit against NFT artist Ryder Ripps and several of his associates for alleged trademark infringement on grounds of:

“False designation of origin, false advertising, cybersquatting, trademark infringement, unfair competition, unjust enrichment, conversion, and tortious interference.”

Additionally, Yuga has opened suit against Ryder Ripps on grounds of defamation after a January video created by the artist claimed it had identified numerous hidden Neo-Nazi references throughout the BAYC lexicon. The original video has since been removed, but an additional video can be found here.

Ryder Ripps presents some of his thoughts in a twitter thread below:

See Also: Cryptoslate; Decrypt

2. 3AC Hires Legal And Financial Advisers To Help Avert A “Bankruptcy” Situation

O’, how the mighty have fallen:

The Singapore-based cryptocurrency hedge fund Three Arrows Capital (3AC) has reportedly hired external financial and legal advisers to help work out a potential in-house solution for its users and lenders, even as the firm slips ever closer to bankruptcy. The move comes on the heels of an avalanche of recent crypto collapses, which include the fall of UST and Celsius as well.

Though their backs are against the ropes, the firm has yet to toss in the towel. As they inch nearer to possible liquidation, outrage in the Web3 community over “imposter” DeFi protocols have continued to escalate. Perhaps the crypto community at large just needed to shake out some of the bad seeds in the industry before the next run upwards. Time will tell. For now, the freefall continues.

See also: Crypto Broker Voyager Likely to Issue Default Notice to Three Arrows

3. BTC: NYU Law Professor Explains Why “Bitcoin Isn’t Going Away”

Tough Chin // Strong Right Hook:

As global markets at large continue to reel, and the United States economy continues to flirt with recession; Max Raskin, Adjunct Professor of Law at New York University School of Law, claims that now is the time for BTC to showcase it’s durability. He argues that “Bitcoin isn’t going away because the ideology underlying it isn’t going away.”, in an attempt to alleviate some of the fear and mistrust that has developed in the wake of the commodity’s collapse in price. He goes on to elaborate:

“It may seem paradoxical to invest in a ‘predictable’ money that loses 70% of its value, but early investors believe that in the long run the predictability of supply will be more important than demand-driven booms and busts. Bitcoin ownership is highly centralized in the hands of individuals who seldom move their coins. If you weathered the 2011 crash from $30 to $2 or the 2018 plummet from $19,000 to $5,000, this latest crash won’t shatter your belief in this project.“

Mr. Raskin clearly has confidence that BTC’s time in the ring is not yet finished. What about you, anon?

Bitcoin Advances as Concerns Over Deleveraging 'Cascades' Ease

4. Are 'Decentralized Autonomous Organizations' the Business Structures of the Future?

Reinventing the Wheel

Decentralized Autonomous Organizations (DAOs) continue to disrupt the foundational understanding of what constitutes a “Legal Entity”. In this article, the World Economic Forum explores the possibilities both known and unknown to the novel structure types, and offers a “beginners guide” to what DAOs are and how they function.

“DAOs promise new forms of organization structures and collaboration in the digital and global space. As significant digital value is created, through non-fungible tokens or the metaverse, DAOs could be the native entity for value creation in cyberspace. Many blockchain protocols are built as global collaborations across borders. DAOs are supposed to enable trustless and decentralized collaborations by coding governance rules.”

The road ahead may not be so simple, however, as many obstacles yet remain on the road to legal and functional clarity for DAOs. Thankfully, there are lots of hardworking Web3 attorneys on the case - and we may soon live to see the implementation of a new vehicle “wheel” by which companies travel and interact.

5. Crypto-Linked Super PACs Boost Spending on Primary Races

Politics as (not so) Usual:

As the United States nears election season, a new political weapon has entered the playing field arsenal: Crypto-Pacs. The appeal of highly liquid funds has apparently not been lost on donors or politicians seeking to tap into the emerging crypto market, with Roll Call author Caitlin Reilly noting:

“Super PACs with ties to the cryptocurrency industry have spent at least $31.2 million in primary races ahead of this year’s midterms, with most of the money coming from a handful of executives at just one company.”

Craig Holman, a lobbyist for Public Citizen, commented on the unusual and unorthodox marriage of finance and politics occurring ahead of the races, saying:

“What we're seeing is a fundamental politicization of the cryptocurrency industry,” Holman said in an interview. Cryptocurrency industry insiders have emerged as political megadonors just as Washington lawmakers and regulators have flexed their muscles in the space.”

As it already has with so many other industries, it appears Crypto is now poised to join the political arena en force.

See also: More cryptocurrency PAC money boosting Jonathan Jackson’s bid for Congress: new total $991,276

Podcasts, Videos, and Blogs

The brightest voices & sharpest pens:

In episode #52 of Law of Code, Jacob Robinson sits down with Peter Van Valkenburgh (@valkenburgh) to discuss his role at Coin Center, the U.S. Constitution & Crypto, and the SEC's definition of an exchange:

In Ep. 365 of Unchained, Laura Shin is joined by CFTC Commissioner Caroline Pham to talk about how to build a regulatory framework for crypto assets, whether the SEC and CFTC should work together, what were the consequences of the Terra collapse, and much more:

@Bankless Podcast team discusses 3AC, dYdX, and Uniswap:

Ann Sofie Cloots delivers yet another amazing edition of CryptoLaw’s newsletter with edition no. 55:

Bird Watching

Tweet, Tweet, Tweet!

It looks as though Ripple have decided to take their ball and go home if worst comes to worst:

Our friend @Lawtoshi continues to generate profoundly relevant content regarding crypto law. Check out his exploration of the CFTC and digital commodities below:

@paddi_hansen offers some firsthand insight on upcoming EU crypto regulatory efforts:

Have you ever wanted the chance to tell your democratically elected representatives exactly how you feel? Today’s your lucky day:

Motion To Compel

Thought-provoking questions and arguments for your consideration each week:

Three Months In: A Refresher on the Presidential Executive Order on Digital Assets

By Riley D. Matthews

On March 9, 2022, President Biden issued the Executive Order on Ensuring Responsible Development of Digital Assets, sounding the call for an extensive review of digital assets and cryptocurrencies. The overall objective of the executive order was to examine the risks and benefits of cryptocurrencies, as well as to set in motion such research conducive to building a fair and safe market with adequate and proper regulatory considerations to ensure the safety of investors. This signals a growing interest in crypto currency and digital assets, which had grown to a $3 trillion digital asset market cap as of November of 2021. The following is a summary of the key sections of the executive order, with much of the assigned research set to be completed before years end. Three months after the issuance of the order, several questions begs to be asked:

Do you believe the objectives of the Biden Administration have been addressed properly?

Do you find that the federal government has been and will continue to be accurate in their assessments and reports?

How far would you like to see any resulting regulations extend?

Follow the link in the title or click HERE to read the full piece by Riley D. Matthews. Riley is the Public Relations Chair for Stetson Blockchain & Law Society and currently working as a Summer Associate at CoreX Legal.

All views expressed in this section are the sole opinion of the author and are not necessarily reflective of those held by Around the Blockchain managers, editors, contributors, or associates.

The Public Ledger

Highlights from the hundreds of sources gathered each week by our research AI. Always DYOR - but in case you don’t have time, here’s some of ours:

General News and Opinion

How Budding Lawyers Can Prepare for a Career in Blockchain World

Crypto broker Voyager Digital lowers daily withdrawal limits to $10000

A Digital Dollar for the Unbanked? Banks, Consumers See Pitfalls

Bitcoin billionaire Sam Bankman-Fried bails out embattled crypto firms BlockFi and Voyager

Puma makes big Web3 push as sports brands go all-in on the metaverse

U.S. - Federal

Lummis-Gillibrand Bill Could Establish Cryptocurrency Regulation

Dear Sophie: What are my F-1 OPT options if my crypto job is no longer available?

Senators on NFTs, Ask US Patent and Copyright Offices about IP Rights

CFTC advocates for expansion of cryptocurrency market jurisdiction

A legal challenge over crypto reporting could strike down decades-old anti-money laundering laws

Ripple v. SEC: Plaintiff wants to protect the ‘Expert’ at all costs

The future of digital asset regulation? The CFTC, says Congressional committee

U.S. - State Law

Bitcoin Holders Will Soon Be Able to Store Crypto at Louisiana Banks Under Pending Law

New York State Releases Payment Stablecoin Regulatory Guidance

Alex Mashinky's Celsius crypto bank draws probe by five states

Blockchain and South Florida: Four Things the Legal Community Should Know

First ever commercial real estate title in Utah minted as an NFT

International

CoinDCX restricts crypto withdrawals citing higher compliance requirement

Making Bitcoin Legal Tender In Africa: How CAR Can Find Financial Freedom

Crypto Crash Survivors Could Be Tomorrow's Amazons, BOE Says

DOJ Report Calls For International Cooperation to Fight Digital Asset Crime

Closing Statements

We want to hear from you:

If you enjoyed what you read today, subscribe to receive the weekly publication and give the authors a follow on Twitter for updates on what’s next for the newsletter!

If you didn’t enjoy it, let us know why! We value the opinion of our readers above all else. After all, this letter is for you. - Kyler & Chris

Stetson Blockchain & Law Society X Around the Blockchain Collaboration:

Around the Blockchain is excited to announce the first of a series of collaborations we will be participating in throughout the summer: We will be working with the law student collective Stetson Blockchain & Law Society! We’re thrilled to have these sharp and enthusiastic (future) attorneys joining our team. The first of their contributions was written by Riley D. Matthews and is our Motion to Compel for this week. Moving forward, students from Stetson will be given their own section each week in which to provide material relevant to the world of Crypto & Law.

Interested in Collaborating with Around the Blockchain?

We are always looking for other passionate groups and individuals making meaningful contributions to crypto law. If you think you fit the bill - reach out to us! We want to give you a platform and to make your voice heard. Announcing new collaborations soon!

Quote of the Week:

“Good intentions can often lead to unintended consequences. It is hard to imagine a law intended for the workforce known to Henry Ford can serve the needs of a workplace shaped by the innovations of Bill Gates.” - Tim Walberg

Ok, all done! You can go ahead and check your P/L now (Coin Market Cap)

This newsletter is curated, annotated, and edited by Christopher Foreman (Twitter - @CryptlessInSEA) and Kyler Wandler (Twitter - @KylerW56); with consultation and input from Jacob Robinson of the Law of Code Podcast; editing courtesy of TΞxas ₿l◎ckchain LawyΞr ; in collaboration with Ann Sofie Cloots; and support from the Blockchain Barristers Law Student Collective and the Stetson Blockchain & Law Society.

The articles and opinions in this newsletter are not legal or financial advice. For legal and financial guidance, please consult a qualified attorney or financial advisor.

Special thanks / image credits:

Law / Scale Image; Twitter Image; Blockchain Image; Podcast Image; P / L Image; Monkey JPEG; Freefall GIF; Boxing GIF; Wheel GIF;