Edition No. 41

SVB and SI Banking Collapse; NYAG Sues KuCoin; German BaFin on NFTs; Binance.US Purchase; MO Crypto Mining Bill; and more. Here's what happened from 3/5/2023 - 3/11/2023

Welcome back to Around the Blockchain, the weekly letter dedicated to keeping readers like you up to date on the fast-paced world of Crypto & Law by airdropping current stories directly to your browser.

Table of Contents:

1. On the Docket (Top Stories of the Week)

2. Bird Watching (Tweet, tweet!)

3. The Public Ledger

4. Podcasts, Videos, & Blogs (The faces, voices, and pens of Web3’s brightest contributors)

5. Closing Statements

On the Docket

Five things you might have missed last week:

Collapse of Tech-Focused Banks Create Unease

Slippery Slopes 📉

The recent collapse of two tech-focused banks, Silicon Valley Bank (SVB) and Silvergate, has raised questions amongst investors about the potential ramifications for the broader financial system.

The California Department of Financial Protection and Innovation shut down SVB and appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect insured depositors, the FDIC created the Deposit Insurance National Bank of Santa Clara (DINB), which will maintain SVB’s normal business hours.

As of December 31, 2022, SVB had approximately $209.0 billion in total assets and about $175.4 billion in total deposits. At time of closing, the amount of deposits in excess of the insurance limits was undetermined, and the amount of uninsured deposits will be determined once the FDIC obtains additional information from the bank and customers.

“This is the first sign there might be some kind of crack in the financial system.”

- Bill Smead, Chairman of Smead Capital Management

The collapse of Silvergate stems from similar circumstances to that of SVB. One common denominator is both banks have been impacted by interest-rate hikes from the Federal Reserve. These hikes have drastically cut the value of long-term bonds they bought before rates went up, meaning low-interest bonds bought before 2022 are currently worth less than the defunct banks originally paid for them.

This has led to concerns about other banks in a similar position–Christopher Whalen, Chairman of Whalen Global Advisors, stated “a lot of the small guys are going to take a terrible kicking”.

See Also: FDIC Press Release; Business Insider

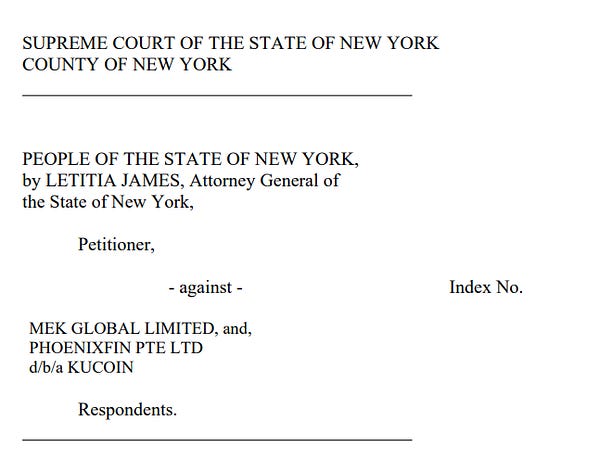

New York Attorney General James Sues KuCoin, Alleges ETH is a Security

When It Reigns, It Pours

New York Attorney General Letitia James has filed a lawsuit against KuCoin, a virtual currency trading platform, for failing to register as a securities and commodities broker-dealer, falsely representing itself as an exchange, and allowing New York investors in to buy and sell cryptocurrencies without registering with the state. General James is seeking to stop KuCoin from operating in New York and block access to its website until it comes into legal compliance.

The AG’s lawsuit specifically alleges KuCoin sold unregistered securities in the form of KuCoin Earn, the platform's lending and staking product, and further alleges KuCoin claimed to be an exchange while failing to register with the proper authorities as required under New York Law.

Notably, the petition argues ETH– same as LUNA and UST–is a speculative asset relying on the efforts of third-party developers to provide profit to ETHholders. This action is one of the first times a regulator is claiming in court ETH, one of the largest cryptocurrencies available, is a security.

“Today’s action is the latest in our efforts to rein in shadowy cryptocurrency companies and bring order to the industry.”

- NY AG Letitia James

See Also: Lawsuit Filing; CoinDesk

German Regulator BaFin Weighs In On NFTs

Ich Bin Ein Security?

German regulator BaFin has suggested non-fungible tokens (NFTs) be classified on a case-by-case basis rather than automatically designated securities. BaFin's journal recently outlined the legal classification of NFTs, stating the tokens did not currently meet the requirements to be classified as such.

However, BaFin noted NFTs could be viewed as securities if a group of NFTs reflected the same repayment and interest claims. The German authority does not anticipate NFTs will adhere to license requirements, and exempts them from anti-money laundering oversight, as opposed to fungible assets, which fall under the category of financial instruments.

US Bankruptcy Court Approves Binance.US Purchase of Voyager Over Regulator Objections

A Fantastic Voyage[r] Purchase For Binance.US

Binance.US has won court approval to purchase Voyager Digital, despite objections from federal and state regulators as well as some investors.

US Bankruptcy Judge Michael Wiles rejected claims by the US Securities and Exchange Commission that parts of the deal and payout plan violate federal law. Wiles criticized the SEC for attacking the sale and plan without actually saying the Commission had concluded either was illegal. The SEC and other federal lawyers argued the payout plan could undermine future efforts to police cryptocurrency markets.

Proponents of the sale argue it will give customers approximately $100m more than if Voyager were to liquidate on its own.

“I cannot put the entire case into indeterminate deep freeze while regulators figure out whether they believe there are problems with the transaction and plan,”

- Judge Michael Wiles

See Also: CoinTelegraph

Missouri House Passes Bill Protecting Crypto Mining

MO Bill Aims To Protect Crypto Miners From Getting The Shaft

Missouri has passed the "Digital Asset Mining Protection Act" codifying the rights of crypto miners. The bill prohibits state and political subdivisions authorities from halting crypto mining nodes and while ensuring crypto-mining companies are subject to the same laws as other businesses.

It primarily aims to prevent energy companies from applying discriminatory tax rules on mining operations. The bill legalizes crypto mining and allows institutions to participate in mining activities within approved industrial use zones.

It passed with a unanimous vote and now needs to be passed by the Missouri House committee before moving to the Senate.

See Also: Text of HB 764 “DIGITAL ASSET MINING PROTECTION ACT”

Bird Watching

Tweet, Tweet, Tweet!

The Public Ledger

Highlights from the hundreds of sources gathered each week by our research AI. Always DYOR - but in case you don’t have time, here’s some of ours:

General News and Opinion

The Rise of Central Bank Digital Currencies (CBDCs): Impacts on the Crypto Market

AI and Blockchain Technologies Benefit Company ESG Reporting

U.S. - Federal

Ripple v. SEC: Legal expert shares predictions of 5 outcomes

Stablecoins and Ether are ‘going to be commodities,’ reaffirms CFTC chair

U.S. - State Law

International

Ukraine’s central bank sees both promises and threats in Bitcoin

The Regulatory Landscape of Crypto: Global Developments and Implications

Podcasts, Videos, and Blogs

The brightest voices & sharpest pens:

Law of code - Jacob Robinson dives into Grayscale Investments’ suit against the SEC.

Bankless - The Bankless team discusses all the crypto news that took place in the second week of March including Silvergate, Grayscale v. SEC and an Amazon NFT marketplace.

Bloomberg Crypto - Bloomberg’s Stacy-Marie Ishmael sits down with Circle CEO Jeremy Allaire to discuss stablecoins and his views on US crypto regulation.

DaoTalk - DAO Talk discusses the rise of Governor DAOs with Dennison Bertram, CEO and co-founder of Tally.

Unchained - ”The Chopping Block!” team is joined by BitMEX founder Arthur Hayes for a deep-dive into SBF, TradFi’s failings and why crypto needs to ditch the banks!

Closing Statements

We want to hear from you:

If you enjoyed what you read today, subscribe to receive the weekly publication and give the authors a follow on Twitter for updates on what’s next for the newsletter!

If you didn’t enjoy it, let us know why! We value the opinion of our readers above all else. After all, this letter is for you. - Kyler, Chris, and the Around the Blockchain News team.

Quote of the Week:

"Most of the things worth doing in the world had been declared impossible before they were done."

-Louis Brandeis

Thanks for reading Around the Blockchain! Subscribe for free below: